All products featured are independently chosen by us. However, SoundGuys may receive a commission on orders placed through its retail links. See our ethics statement.

Is Tidal actually good for artists?

June 27, 2025

If you’ve ever conversed with a semi-professional musician, chances are they’ve mentioned their despair with music streaming. Not only is it an oversaturated market, but it requires substantial listening numbers to earn even a modest living. While Spotify is by far the most popular streaming service today, Tidal has gained popularity in recent years. This is largely thanks to its supposed higher royalty payouts and support for Hi-Res audio formats. But when all is said and done, is Tidal actually good for artists?

Listeners vote with their ears

Music streaming has experienced exponential growth since 2004. According to the 2024 IFPI Global Music Report, streaming services accounted for 69% of global music revenue last year. This marks a 7.3% increase on 2023, with subscription streaming growing by 9.5% and ad-supported streaming growing by 1.2%. By contrast, physical sales declined for their 18th consecutive year by a total of 3.1%. Revenues from downloaded content and other digital formats also fell by 7.7%.

Of all the major players, Spotify is by far the largest music streaming service in 2025. For example, the platform increased its global user base by 10% last year, reaching a total of over 678 million monthly users. Likewise, the company enjoys 268 million paying subscribers. According to its First Quarter 2025 Earnings Report, Spotify paid out $10 billion to the music industry in 2024. Of this, nearly 50% went to independent labels and artists. Even more striking is that the company generated approximately $4.8 billion in revenue in the first quarter of 2025.

Spotify owns a substantially larger portion of the music streaming market than Tidal.

By comparison, Tidal’s parent company, Block, saw significantly smaller margins at the tail end of last year. Block’s Q4 2024 Shareholder Letter reveals that its “Corporate and Other” category, in which Tidal resides, made revenues of roughly $46 million in the last three months of 2024. This was down over $4 million from the previous year and could be an indication that Tidal may be nearing its end. After all, a report by Digital Music News last year revealed the company owns a meagre 0.5% share of the dominant U.S. music streaming market.

This pales in comparison to rivals like Spotify, Apple Music, Amazon Music, YouTube Music, and Pandora Premium. According to the report, these companies enjoy U.S. market shares of 36%, 30.7%, 23.8%, 6.8%, and 1.9%, respectively. While this alone may not answer whether Tidal is good for artists, it does reveal some interesting facts about listener preferences. In particular, it appears that most fans care more about an intuitive user interface, comprehensive playlisting, and ubiquitous third-party integrations than about audio quality and royalty payouts, on which Tidal prides itself.

Battle of the apps

However, what defines whether a music streaming platform is good for artists is more nuanced than popularity alone. Instead, artists require promotional tools and direct access to audience listening data to stand out in today’s competitive music industry. For example, Spotify’s sister app, Spotify For Artists, is essential for conducting successful release campaigns. Musicians can upload album artwork, video canvases, biographies, and Artist Playlists to connect with their fans. The app also integrates with Shopify, allowing artists to sell merchandise directly from Spotify. Similarly, uploading lyrics to the third-party Musixmatch platform displays synchronized lyrics in Spotify. Artists can also realize important listener habits using the company’s comprehensive analytics tools.

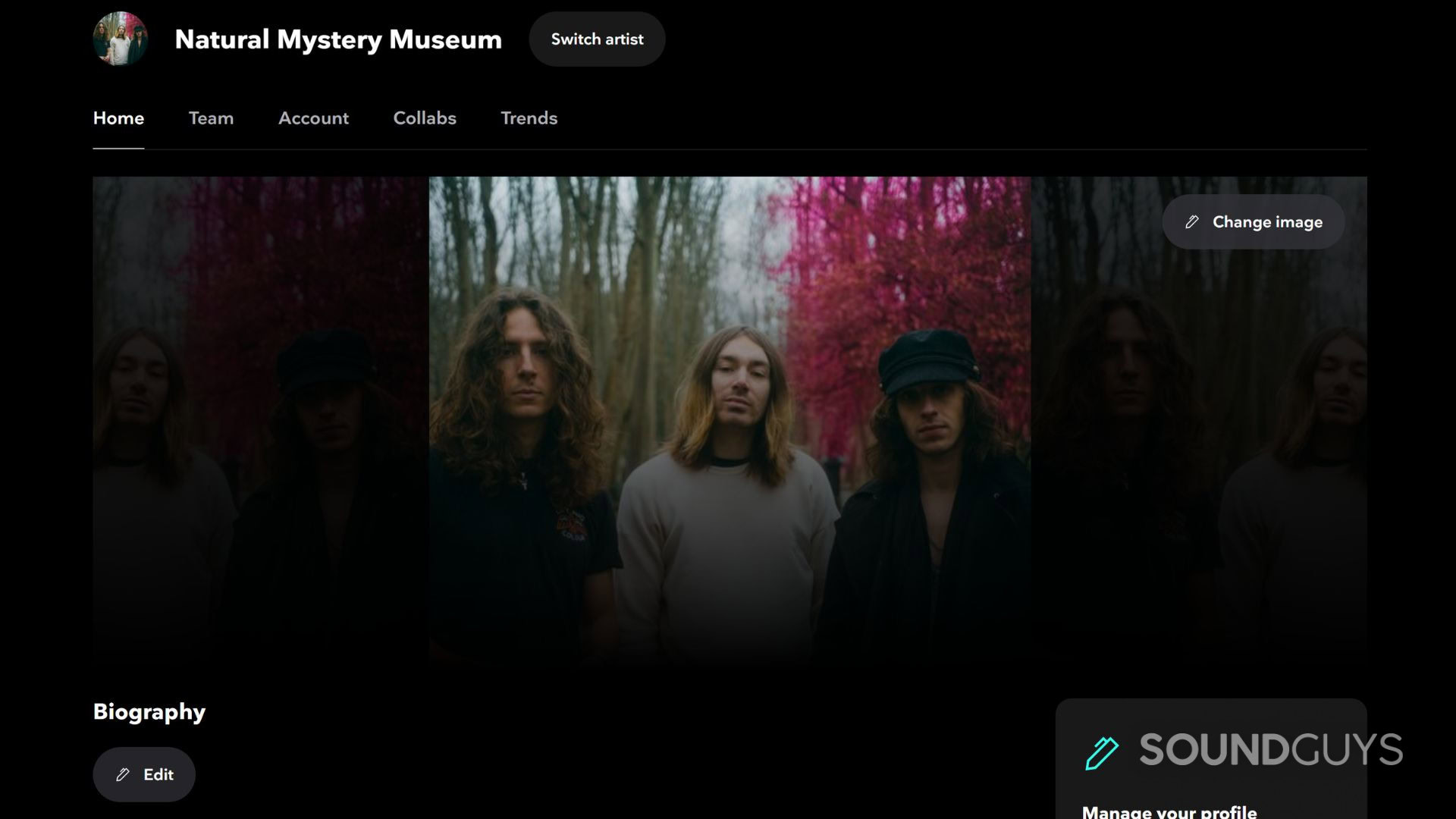

Tidal has its own dashboard and release tool called Tidal Artist. However, unlike Spotify’s sister app, Tidal Artist is only supported as a web app. To use it, musicians must first create a personal account and then claim their artist profile by following a series of identity checks. Once claimed, Tidal Artist provides tools for editing your artist profile image, biography, social media accounts, and team members. The Trends tab works similarly to that found in Spotify For Artists, providing metrics for listener ages, top countries, top tracks, and more.

Analytics tools are vital for connecting artists to their audiences and conducting a successful music campaign.

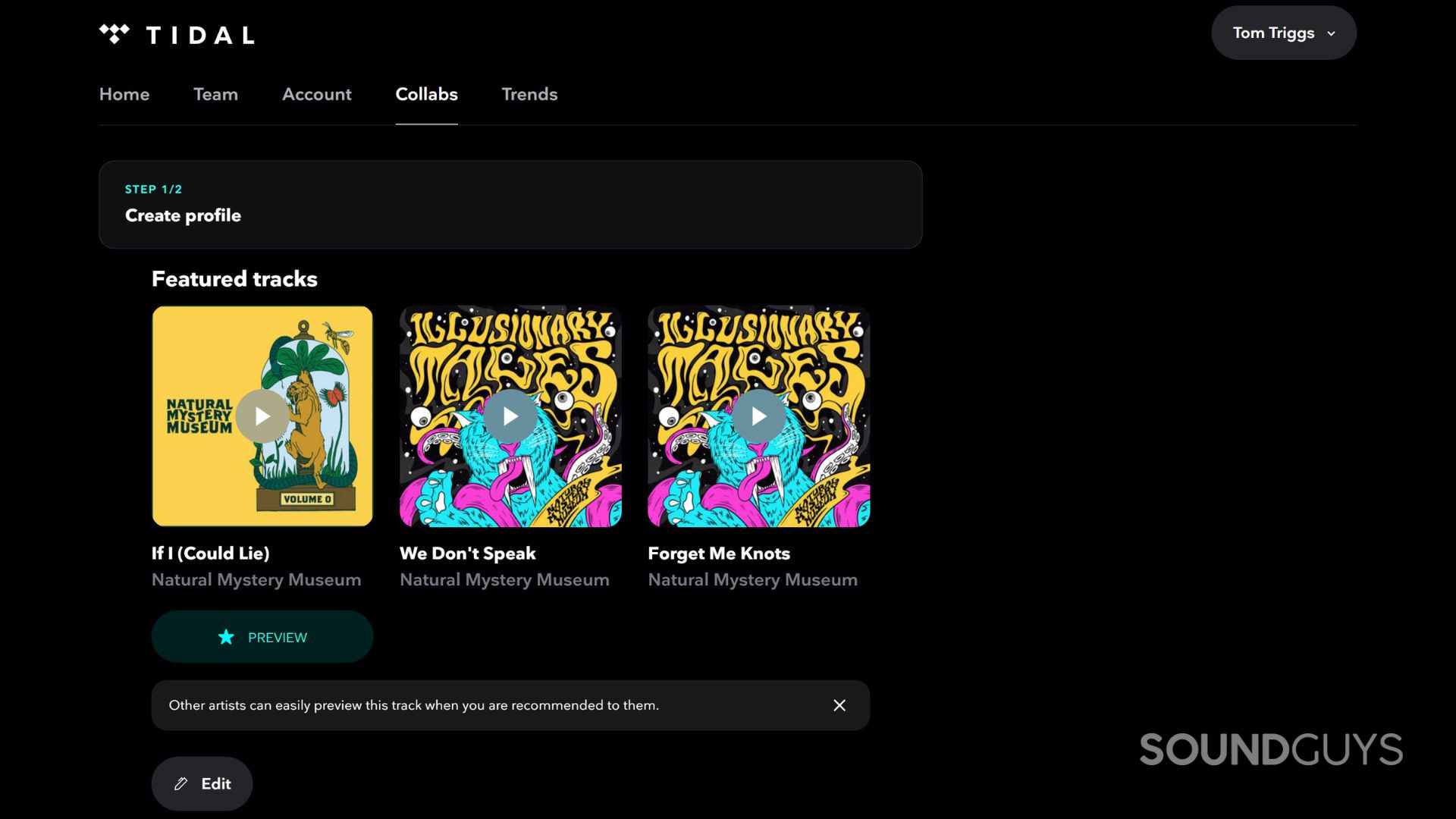

However, Tidal takes a step ahead of Spotify with its Tidal Collabs service. This is a dedicated feature designed to help artists find and connect with potential collaborators. In essence, artists can customize their profile with an artist image, location, featured tracks, and track story. Afterward, they can network with other artists by browsing the “recommended for you” field and sending direct messages. Once connected, artists can convert audio files as large as 100MB from FLAC, AIFF, ALAC, MP3, AAC, Ogg / Vorbis, and M4A to MP3 for preview and playback in a web browser.

Tidal also features handy discovery playlists to promote music to new audiences. For example, Tidal Daily Discovery is a personalized playlist comprising songs based on your previous listening preferences. However, even more useful is Tidal’s artist promotion program called Tidal Rising. This provides access to educational tools, industry connections, and potential playlist opportunities. Joining the community allows artists to enroll as a Tidal Rising ambassador. Successful candidates can then unlock funding and receive direct access to the Tidal artist relations team.

Money in the pocket

It’s no secret that most emerging talent will struggle to cover recording costs with streaming royalties alone. To make matters worse, some platforms have made earning royalties even harder in recent years. For example, Spotify introduced a policy overhaul in 2023 that stops songs with fewer than 1,000 yearly streams from earning recording royalties, even though 99.5% of all streams were already of tracks that have at least 1,000 annual streams. Instead, these funds are redirected and redistributed among the artists on the platform with more streams. Similarly, most streaming services operate a “market share” royalty distribution model. Essentially, platforms, including Tidal, pool all the subscription and advertising revenue generated from users. This is then distributed to rights holders based on the proportion of total streams that each artist’s music receives. So if Taylor Swift accounts for 2% of all streams on Tidal, she would receive 2% of the total royalties pool.

While this may sound fair in principle, it leaves the door open to malign practices. For example, streaming services could flood their platforms with AI-generated music to dilute royalty payouts to real artists. The “market share” distribution model also makes it difficult to quantify royalty payments on a per-stream basis. While Tidal prides itself on paying artists more per stream than most of the competition, this varies depending on an artist’s contract with digital distributors. Taken with a huge pinch of salt, artists can expect to receive roughly $0.013 per stream from Tidal in 2025. This compares to Spotify’s $0.004 per stream and Apple Music’s $0.01 per stream. In context, a musician would need approximately 7,700 Tidal streams to earn $100, compared to 23,000 on Spotify and 10,000 on Amazon Music.

Tidal, like most other streaming services, operates a trickle-down distribution model that makes it hard for emerging artists to earn a living.

However, in addition to individual contracts with record labels and digital distributors, your listeners’ location will affect royalty earnings. This is because Tidal subscriptions are more expensive in certain countries, such as the U.S. and the U.K. For example, a Tidal Individual subscription plan costs $10.99 in the U.S. and £10.99 (~$15) in the U.K., compared to R$15.99 (~$3) in Brazil. Consequently, if your audience is primarily located in Brazil, you will earn fewer royalties than an artist with the same number of streams whose fan base is located predominantly in the U.S.

Nevertheless, Tidal merged its Individual and HiFi Plus subscription plans in April 2024. Now, listeners automatically receive Hi-Res FLAC and MQA 24-bit/ 192 kHz audio streaming, in addition to Dolby Atmos spatial audio. Unfortunately, this merger ended Tidal’s Direct Artist Payouts (DAP) program, which paid out up to 10% of your HiFi Plus subscription fee to the artist you listened to the most. This also allowed you to track how your listening habits funded your favourite artists. Instead, the company’s DAP program has been replaced with funding for emerging artists through the aforementioned Tidal Rising program.

But what do you think? Is Tidal good for artists, or do dominant streaming services like Spotify reign supreme with their superior subscriber count and listener analytics tools through Spotify For Artists? Let us know in the poll below.

Is Tidal good for discovering emerging artists?

FAQs

In some regards, yes. For example, Tidal pays more per stream on average than Spotify. The platform also has programs like Tidal Rising to nurture and fund emerging talent. Similarly, Tidal supports high-resolution FLAC audio streaming, whereas Spotify is limited to 320kbps, 16-bit/ 44.1 kHz audio sampling. However, Spotify has a larger pool of listeners, and the Spotify For Artists sister app has more comprehensive tools for promoting new music and analysing audience interactions.

Qobuz leads the pack regarding royalty payments, profiting $0.022 per stream on average. This compares to $0.02 from Napster, $0.013 from Tidal, and $0.01 from Apple Music. However, deciding which music streaming service is best for artists is a nuanced conversation. For example, Spotify has the largest music streaming market share. Consequently, artists can connect with a larger audience through Spotify's algorithmic and editorial playlists.

Yes. The Tidal Artist web application provides tools for editing Tidal profiles, uploading music, messaging potential collaborators, and analyzing audience demographic data.

While this will vary depending on your audience's location, record deal, and distributor agreements, most artists will require approximately 77,000 streams to generate $1,000.

Thank you for being part of our community. Read our Comment Policy before posting.